How to Check Vehicle Status Online? A Full Comprehensive Guide

In a world driven by digital convenience, even the once-complicated task of checking a vehicle's insurance status has been streamlined. Whether you're a conscientious driver wanting to ensure compliance or someone involved in an accident seeking verification, the process has been made significantly easier through the power of technology. In this comprehensive guide, we'll walk you through the steps of checking vehicle insurance status online in the UK, exploring the benefits, precautions, and potential pitfalls along the way.

The Importance of Insurance Verification

The roadways are a shared space, where responsible driving is paramount. Understanding the importance of insurance verification can't be understated. In the UK, it's illegal to drive on any public road without valid insurance. The consequences for such negligence can be severe, ranging from fines and penalty points to vehicle seizure and even disqualification from driving. But fear not, for the Motor Insurance Database (MID) is here to simplify the process.

The Power of the Motor Insurance Database (MID)

The key to easily checking a vehicle's insurance status lies in the Motor Insurance Database (MID) due it's a national register of all insured vehicles in the UK.

The MID has access to the following sources:

- Registered insurance companies,

- Law enforcement agencies,

- DVLA.

The process is remarkably straightforward, offering peace of mind with a simple yes-or-no response.

Step-by-Step Guide to Checking Vehicle Insurance Status

1. Gather Vehicle Information: Start by noting down the vehicle's registration number (REG). This piece of information is your ticket to accessing the MID.

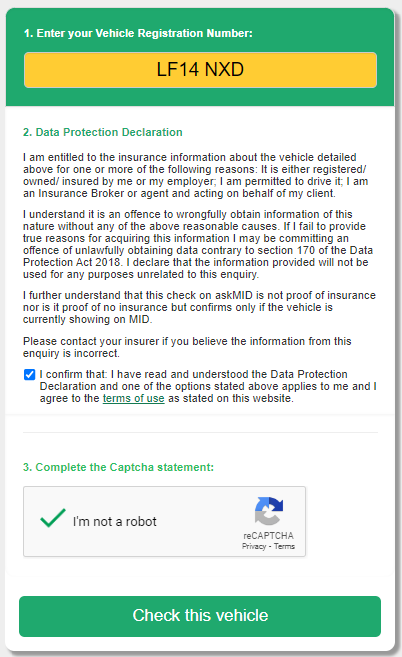

2. Visit the AskMID Website: Head to the AskMID website, the official platform for checking vehicle insurance status online.

3. Enter the Registration Number: Input the registration number into the search bar provided on the website.

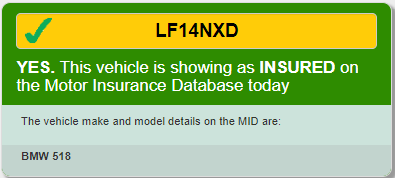

4. Receive Instant Confirmation: The database will provide an instant response, confirming whether the vehicle has a valid insurance policy or not.

Now let’s say you have already fixed your insurance issue, but is it the only thing that keeps you away from using an illegal car? The answer is a HUGE NO, your vehicle might be written off, have mileage anomaly, plate change, and other issues. Here at CarCheckUp, we got you covered. We provide services to unveil your vehicle’s story with all the other details you might need.

Head up to CarCheckUp and unveil the mystery of your vehicle before it’s too late.

Digging Deeper: Additional Details

While the primary goal is to verify insurance status, the MID can provide more information if needed. For a nominal fee, you can access details such as the insurance provider's name and specific policy information. This could be particularly helpful in scenarios where you're looking for additional insights.

Privacy and Security Considerations

As we embrace digital solutions, concerns about privacy and data security are valid. The MID takes these concerns seriously and ensures that user data is protected. This online verification process doesn't compromise your personal information, making it a secure method for accessing insurance details.

Insurance Renewals and Reminders

To ensure you stay on top of your insurance renewals, think about setting up reminders. While askMID doesn't currently provide a reminder service, there are external solutions at your disposal.

The most effective method is through your insurance company. On our blog where we discuss choosing the best car insurance company, you can discover more valuable information.

For instance, there's the option of receiving push notifications on your device. This guarantees that you'll never overlook a renewal date.

Aiding Accident Claims and Accountability

The MID isn't just for personal use; it can be a powerful tool in accident scenarios. If you're involved in an incident, you can use the MID to check the insurance status of the other vehicle. This aids in processing accident claims efficiently and ensures accountability on the road.

Common Queries and Solutions

It's not uncommon for discrepancies to arise, with vehicles being incorrectly marked as uninsured. In such cases, contacting the MID directly is the recommended course of action. They update their database regularly, and any issues can usually be resolved with their assistance.

Buying Uninsured Cars and Continuous Insurance Enforcement

When buying a car, especially from a private seller, it's crucial to ensure insurance coverage immediately after purchase. The Continuous Insurance Enforcement (CIE) scheme mandates insurance unless the vehicle is declared off the road with a Statutory Off-Road Notification (SORN). The responsibility lies with the registered owner, even if not actively driving the vehicle.

Conclusion

In a digital age where solutions are designed to simplify our lives, checking a vehicle's insurance status online is a shining example. The Motor Insurance Database provides a convenient, accurate, and swift way to verify insurance coverage, promoting responsible driving behavior and enhancing road safety. As you navigate the roads of the UK, remember that knowledge is your ally, and with the MID, that knowledge is just a few clicks away.